Direct Indexing for the Masses

Can the strategy provide tax benefits to mutual fund investors?

Two Sources

Tuesday’s column described direct indexing’s approach and goals. (Unless you are already well versed in the topic, I recommend reading that article before proceeding.) Today, I will put numbers to those words. My emphasis, specifically, is not what direct indexing can do for its traditional customer base of extremely affluent investors, but instead for the broader marketplace of mutual fund investors.

The research is not mine. Estimating direct indexing’s tax advantages far exceeds my Excel capabilities. The results instead come courtesy of two sources: 1) Morningstar’s “Sizing up the Potential Tax Benefits of Direct Indexing” (the paper may be downloaded, but only by financial advisors) and 2) calculations supplied by Aperio, a unit of BlackRock BLK.

Stock Market Effects

The first thing to note is that the amount of tax benefit conferred by direct indexing depends heavily on the stock market environment. Extended downturns permit shareholders to realize steep capital losses from their directly indexed portfolios. In contrast, bull markets that lift all boats provide substantially fewer opportunities.

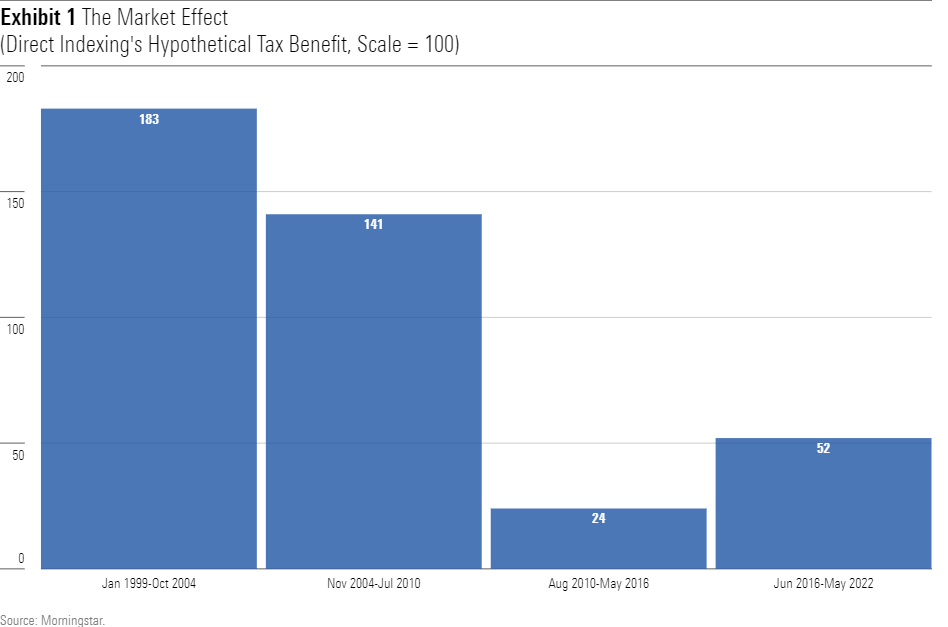

Morningstar’s paper illustrates the power of the stock market effect. The authors compute the annualized tax benefit from direct indexing for a hypothetical investor over a 23-year stretch, then demonstrate how that outcome varies, depending on the period selected. I show their findings below, rescaling their results so that they average 100.

The past is a rough guide indeed! One constant, though, is that direct indexing’s tax benefits have been inversely related to equities’ gains. When stocks have struggled, the tax benefit from direct indexing has been relatively high. In contrast, when they have shone, it has dwindled. Such is the nature of the beast; expect that pattern to persist.

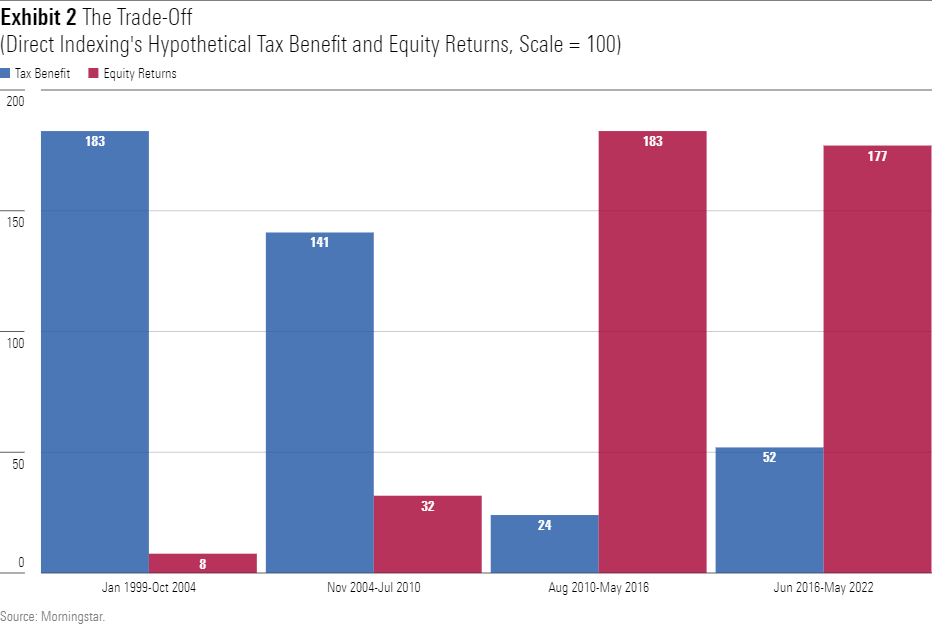

The next chart depicts this inverse relationship. Again, all figures are scaled so that their average score is 100.

Investor Assumptions

Relatively few investors will receive a tax advantage by direct indexing. The strategy does not confer meaningful tax benefits unless the investor 1) owns taxable accounts (the mandatory starting point) and 2) realizes a significant amount of capital gains from those accounts.

That combination is uncommon. Only one third of American households own taxable investments. Most of those households do not receives regular capital gains (as they either buy and hold stocks/bonds or own index funds), and most of the households that do realize capital gains don’t realize significant amounts.

Thus, as a tax-management tool, direct indexing is only for a minority.

Within that context, though, I will present the relatively democratic situation of outcomes that relate to mutual fund shareholders rather than to hedge fund owners. That is, the investor is assumed to have a large income but not huge; a large portfolio but not huge; and to invest for the long term, rather than trade frequently.

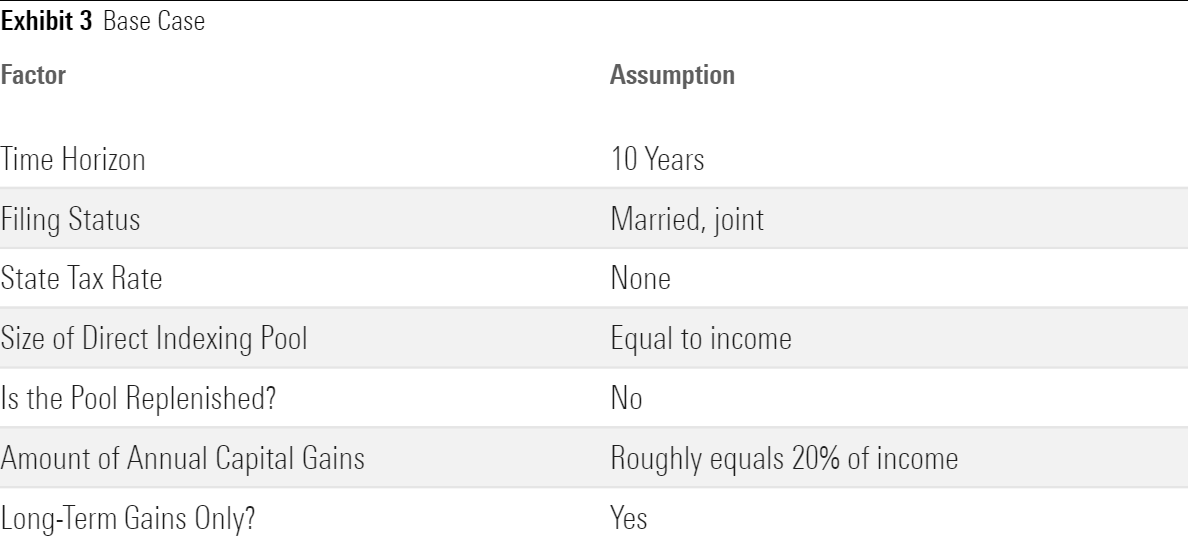

Here are the other assumptions that underpin the forthcoming tax-benefit estimates.

The first three items require little explanation. The rest I will address now.

1) Size of Direct Indexing Pool

This refers to the starting value of the direct-indexing account, from which capital losses will be harvested to offset capital gains realized in the investor’s other taxable account(s). (Should the investor either lack other taxable accounts or not generate capital gains within them, this exercise is moot. In such cases, direct indexing offers no tax reduction.)

2) Is the Pool Replenished?

Ongoing investments into directly indexed accounts create greater capital-loss opportunities, because the new money will likely possess a higher cost basis. The base case uses the conservative assumption that the investor seeds the pool initially, but then does not replenish it.

3) Amount of Annual Capital Gains

Although not every household realizes capital gains in its taxable accounts, those that do tend to receive surprisingly high amounts, equal to about 20% of their annual reported income.

While this assumption is based on a verifiable fact, as it comes directly from the 2019 IRS Data Book, it nevertheless warrants close attention. Within that average, personal experiences vary widely. And those variations will sharply affect the level of direct indexing’s tax effects.

4) Long-Term Gains Only?

Most capital gains paid by mutual funds are long-term rather than short-term. This exercise assumes that all of them are long-term.

The Upshot

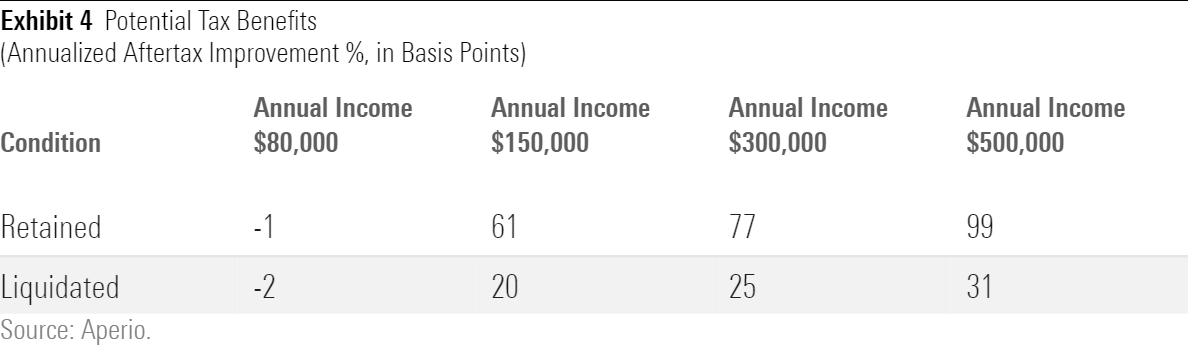

At long last, we reach this article’s payoff: the estimates for direct indexing’s tax benefits. I show eight possibilities—four income levels, each of which face two possible conditions: 1) the directly indexed portfolio is retained when the 10-year period ends, and 2) the directly indexed portfolio is liquidated.

The disposition of the portfolio makes a big difference, because in the first situation, the IRS remains at bay. That is, the taxes that were deferred through the direct-indexing strategy remain unpaid. In the second instance, however, the IRS Reaper collects his due. The stocks in the directly indexed portfolio with high unrealized gains must be sold. Doing so sharply reduces—although it does not necessarily eliminate—direct indexing’s tax benefit.

It may be objected that the IRS always gets paid, which makes the preliquidation results for marketing purposes only. But that argument is overstated. Donated assets escape the taxman, as do those that are bequeathed (assuming, that is, they do not qualify for the estate tax).

Enough preamble. Here are the results, as computed by Aperio.

Given that retail direct-indexing services cost about 35 basis points per more per year than do the leading exchange-traded funds (Fidelity’s and Schwab’s SCHW offerings each charge an annual 40 basis points), they deliver no expected net tax benefits for these putative mutual fund investors should the portfolio be liquidated. If the assets are retained, though, then direct indexing appears to be helpful for all but the lowest listed income level.

Next Time

To generalize—a sin that must be committed with this topic, to reach any conclusion—direct indexing is unlikely to deliver net tax benefits to typical mutual fund investors who do not pay state income taxes, unless they donate or bequeath their assets. Left unaddressed, though, has been the math for those who live in high-tax states, or for those atypical mutual fund shareholders who receive short-term capital gains from investments other than publicly traded funds.

Tuesday’s column will address those conditions.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MG6XOCYGF5BO7MG5YRNBISB3SA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TXAOQ3NTDNAVLGMP3O4BVUVFTA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RH6K4NMACRHO3DQIPX57HVLLAU.png)